Monthly Recurring Revenue, commonly known as MRR, is one of the most important metrics in the Software as a Service (SaaS) industry. It is a measure of the predictable and recurring revenue components of your subscription business. Understanding MRR is crucial for any SaaS business as it provides insights into the financial health and growth potential of the company.

This glossary article will delve into the intricacies of MRR, explaining its formula, definition, and unit economics. We will break down each aspect in detail, providing a comprehensive understanding of this critical SaaS metric.

Definition of Monthly Recurring Revenue (MRR)

Monthly Recurring Revenue (MRR) is the amount of revenue that a subscription-based business can reliably expect to receive every month. It is a key performance indicator (KPI) that provides a clear picture of a company’s financial health and future growth potential. MRR is particularly important for SaaS companies because it helps them understand their revenue patterns and make informed business decisions.

Unlike one-time sales, subscription-based businesses have recurring revenue, which provides a steady income stream. This recurring revenue is predictable, which makes it easier to plan for the future. MRR is a measure of this predictable and recurring revenue, making it a vital metric for SaaS businesses.

Importance of MRR

MRR is a critical metric for SaaS businesses for several reasons. First, it provides a clear picture of the company’s financial health. By tracking MRR, companies can monitor their growth and profitability over time. This allows them to identify trends, spot potential issues, and make informed decisions about their business strategy.

Second, MRR is a key indicator of a company’s future growth potential. Because it measures recurring revenue, MRR can help companies forecast future revenue and plan for growth. This makes it a valuable tool for strategic planning and investment decisions.

Formula for Calculating MRR

The formula for calculating MRR is relatively straightforward. It involves multiplying the total number of paying customers by the average revenue per user (ARPU). The formula is as follows: MRR = Total number of paying customers x ARPU.

However, calculating MRR can be more complex in practice. This is because MRR needs to account for changes in the customer base and pricing plans. For example, if a customer upgrades or downgrades their subscription, this needs to be reflected in the MRR. Similarly, if a customer cancels their subscription, this will also affect the MRR.

Adjustments to MRR Calculation

There are several adjustments that need to be made when calculating MRR. These adjustments account for changes in the customer base and pricing plans. The main adjustments include new MRR, expansion MRR, contraction MRR, and churned MRR.

New MRR is the revenue added from new customers. Expansion MRR is the additional revenue from existing customers who upgrade their subscriptions. Contraction MRR is the lost revenue from existing customers who downgrade their subscriptions. And churned MRR is the lost revenue from customers who cancel their subscriptions.

Unit Economics of MRR

The unit economics of MRR refers to the financial performance of a SaaS business on a per unit basis. In this context, the ‘unit’ typically refers to a single customer or subscription. Understanding the unit economics of MRR can provide valuable insights into a company’s profitability and growth potential.

There are several key metrics that are used to understand the unit economics of MRR. These include the customer acquisition cost (CAC), lifetime value (LTV), and the LTV:CAC ratio. These metrics provide a detailed understanding of the cost-effectiveness and profitability of a SaaS business.

Customer Acquisition Cost (CAC)

The customer acquisition cost (CAC) is the cost of acquiring a new customer. It includes all the marketing and sales expenses that are incurred to attract and convert a customer. The CAC is a crucial metric as it directly impacts the profitability of a SaaS business. A high CAC can erode the profitability of a company, while a low CAC can significantly boost profitability.

Calculating the CAC involves dividing the total marketing and sales expenses by the number of new customers acquired. The formula is as follows: CAC = Total marketing and sales expenses / Number of new customers.

Lifetime Value (LTV)

The lifetime value (LTV) is the total revenue that a company can expect to earn from a customer over the duration of their relationship. It is a measure of the financial value of a customer to the business. A high LTV indicates that a customer is highly valuable, while a low LTV suggests that a customer is less valuable.

Calculating the LTV involves multiplying the average revenue per user (ARPU) by the average customer lifespan. The formula is as follows: LTV = ARPU x Average customer lifespan.

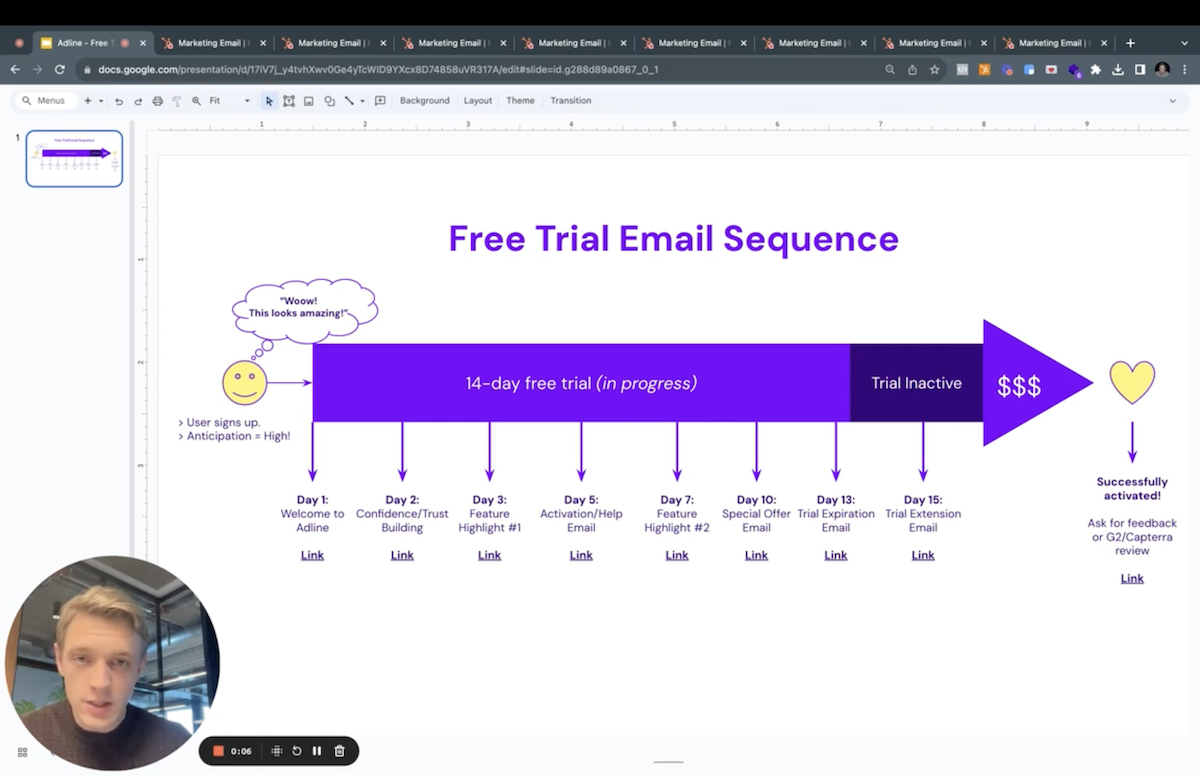

Why Track MRR in SaaS

Tracking MRR is crucial for SaaS businesses for several reasons. First, it provides a clear picture of the company’s financial health. By tracking MRR, companies can monitor their growth and profitability over time. This allows them to identify trends, spot potential issues, and make informed decisions about their business strategy.

Second, MRR is a key indicator of a company’s future growth potential. Because it measures recurring revenue, MRR can help companies forecast future revenue and plan for growth. This makes it a valuable tool for strategic planning and investment decisions.

Forecasting and Planning

MRR is a powerful tool for forecasting and planning. By tracking MRR, companies can predict future revenue and plan accordingly. This can help companies make informed decisions about their business strategy, such as whether to invest in new products or services, hire more staff, or expand into new markets.

Furthermore, MRR can also help companies identify trends and spot potential issues. For example, if MRR is declining, this could indicate a problem with customer retention or pricing. By identifying these issues early, companies can take corrective action and prevent further decline.

Investor Attraction

MRR is also a key metric for attracting investors. Investors look for companies with strong, predictable revenue streams, and MRR is a clear indicator of this. By demonstrating strong MRR, companies can attract investment and secure funding for growth.

Furthermore, MRR can also help companies negotiate better terms with investors. For example, a company with strong MRR may be able to secure a higher valuation or better terms in a funding round. This can provide a significant advantage in the competitive world of SaaS.

As you consider the importance of MRR for your business’s financial health and investor appeal, don’t forget to spice up your revenue streams with Nature Kitchen’s premium gift boxes. Our all-natural, high-quality spice selections are the perfect addition to any product line, offering a recurring delight to foodies, aspiring chefs, and flavour connoisseurs. Each of our spice gift hampers includes 9 carefully curated spice pots and a variety of recipe cards to inspire delicious creations. From meat rubs to marinades and seasonings, our spices are perfect for enhancing sauces, oven roasts, grilled meats, and much more. Check out our Spice Gift Boxes today and discover how the right blend of products can contribute to a robust and flavorful MRR.